Good news. There will be a lot faster cheque clearing. Beginning October 4, India will switch to the continuous cheque clearing system. Pop your cheque in the morning, and you will probably have the cash in your account in the evening. That’s it. No additional waiting days until the money comes in.

RBI is also replacing the previous batch payment system with hourly payments. Banks will clear cheques during the day as opposed to processing them in batches. This brings cheque payments closer to those of UPI and NEFT — fast and reliable.

How Does It Work?

When you place a cheque in the bank between 10 a.m. and 4 p.m., your bank scans and submits it to be cleared immediately. The payments between banks are settled every hour, beginning at 11 a.m.

The paying bank has until 7 p.m. to confirm the payment. Unless they approve it by then, the cheque is automatically approved. Simple as that.

This hourly cycle ensures that your cheque is continuously rolling through the system rather than being placed in the next day’s batch.

What Do You Get From This?

Money shows up faster. Funds are credited in hours instead of having to wait 1–2 business days. Pop in the morning, spend it in the afternoon.

It’s more business cash-flow friendly. Customers are able to make and send payments to businesses on the same day. This assists in the daily running of the organization and shortens the turnaround time of working capital.

Same speed everywhere. Whether in Mumbai or a small town, the clearing rate is the same. The system includes all the bank branches in the three grids of RBI — Delhi, Mumbai, and Chennai.

Follow your cheque online. You will be able to know the exact stage of your cheque in the clearing process. No more guessing or calling the bank again and again.

How We Got Here

Cheque clearing is no longer a big deal. Until the 1980s, it was all manual — bank employees would physically transfer cheques between banks. This took up to a week.

The MICR and CTS technology reduced it to 1–3 days. Then, T+1 national clearing made it possible within one business day. With continuous clearing, we’re now down to hours instead of days. It’s a big jump.

The Rollout Plan

Phase 1 will take place between October 4, 2025, and January 2, 2026. Banks have to verify payments before 7 p.m. This allows time for everyone to adapt to the new system and resolve issues.

Phase 2 starts January 3, 2026. The response time will be reduced to only three hours. By this time, the banks will be accustomed to the process and will act quickly.

On October 3, there will be a trial run to test everything before going live.

Why Cheques Still Matter

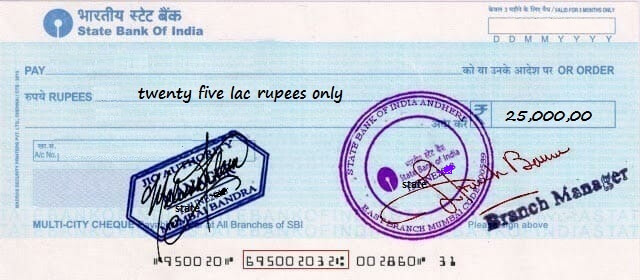

You may consider cheques outdated as there are digital payment options everywhere. However, they are still widely used for large transactions — insurance claims, property dealings, vendor payments, and government disbursements.

It only makes sense to make cheques as quickly as digital payments. They are still required by people and businesses, and that’s why they must be efficient.

What Does This Really Mean?

October 4 marks a big change in Indian banking. It requires real effort to shift from batch processing to hourly clearing — improved technology, new systems, and coordination among thousands of banks.

For ordinary citizens, it means less waiting to get their money. For companies, it translates to smoother operations. The banking system becomes more efficient overall.

Cheques are not going away. This upgrade ensures they remain relevant and aligned with modern needs. Just as you can send money instantly using UPI, it no longer makes sense to wait several days for cheque clearance.

Bottom Line

Effective October 4, cheque clearing in India is set to change — faster, streamlined, and nationwide. You’ll notice the difference whether you deposit cheques occasionally or handle them daily.

The transformation takes place across the country from day one. Every bank branch will operate under the same system. The progressive rollout allows banks time to adjust, and you’ll start to see the benefits right away.

Cheques need to stay in sync with the rest of banking. This system makes that happen.

Follow Us: Facebook | Instagram | X |

Youtube | Pinterest | Google News |

Entertales is on YouTube; click here to subscribe for the latest videos and updates.