For a generation of Indian flyers, Kingfisher Airlines was not just an airline—it was a lifestyle statement. Glamour in the cabin, premium service in the air, and a brand that promised “good times” every mile of the journey. But behind the champagne glasses and glossy advertisements lay cracks that would eventually bring the airline crashing down. Kingfisher’s rise and spectacular fall remain one of India’s most talked-about corporate disasters, raising uncomfortable questions about ambition, accountability, and excess. However, beneath the slick branding and celebrity endorsements, there were fractures that would eventually cause the airline to incur an unbelievable debt of ₹7,000 crore.

What went wrong? Was it financial mismanagement, irresponsible ambition, or the expense of maintaining a lifestyle the business couldn’t afford? One of the most dramatic business collapse tales in India is still Kingfisher’s ascent and fall, and people are still discussing it.

From Sky-High Success To Grounded Failure

An Indian airline group called Kingfisher Airlines Limited was founded in 2003 and began conducting business in 2005. It owned half of the low-cost carrier Kingfisher Red through its parent firm, United Breweries Group.

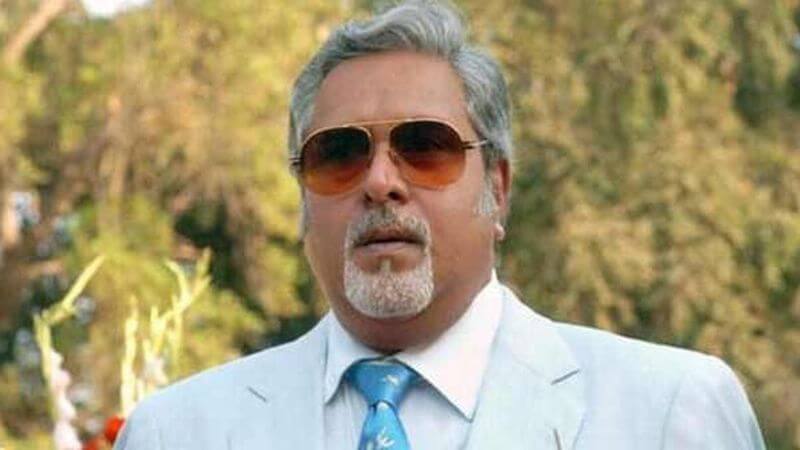

Kingfisher Airlines held the second-largest market share in India’s domestic air travel industry till December 2011. But since its founding, the airline experienced constant losses, accumulated large debt, and ultimately ceased operations on October 20, 2012. After that, its chairman, Vijay Mally, allegedly flew to London to avoid creditors.

An Expensive Vision That Couldn’t Fly

Kingfisher’s poor business plan was a major factor in its failure. Kingfisher opted for luxury at every stage, whereas competitors like IndiGo (founded in 2006) and SpiceJet (founded in 2005) concentrated on keeping expenses down and rates reasonable. The airline created an experience that prioritized luxury over efficiency, from free meals to in-flight entertainment.

However, this strategy was bound to encounter difficulties in India’s extremely price-sensitive market. While passengers appreciated the upscale atmosphere, they eventually chose other airlines’ cheaper tickets. Kingfisher’s business strategy was unsustainable due to its high operating costs and narrow profit margins.

Mallya made the decision to grow in 2007 by purchasing Air Deccan, the first low-cost airline in India. Kingfisher could now access the low-cost market, which seemed like a wise decision. However, the merger proved to be disastrous.

The First Low-Cost Airline In India Was Air Deccan

Combining the two very different brands caused turmoil, and Air Deccan was already losing money. The corporation was unable to discover synergy between a luxury airline and a basic carrier, and the integration costs escalated. The outcome? Growing debt and uncertainty regarding Kingfisher’s identity in the marketplace.

₹17,000 Crore Debt And A Long Fight Ahead

Kingfisher’s flying license was formally revoked by December 31, 2012. By 2025, the airline’s overall liabilities exceeded ₹17,000 crore, despite its core debt of ₹6,848 crore, due to growing interest and penalties. The State Bank of India led the group of 17 nationalized and private banks in their protracted battle to get their money back.

According to reports, Vijay Mallya owed approximately ₹9,000 crore, including interest, when he departed India for London on March 2, 2016. During a Debt Recovery Tribunal (DRT) hearing in April 2016, the banks had already rejected his previous settlement bid of ₹6,868 crore.

By then, Kingfisher’s once-celebrated “good times” had turned into a drawn-out legal dispute.

Tax Troubles, Bank Loans, And A Swift Exit

Mallya’s problems had been developing for years; they didn’t begin suddenly. The Service Tax Department froze Kingfisher’s accounts in December 2011 due to outstanding debts of ₹70 crore. The Revenue Department soon threatened to file a lawsuit for alleged tax evasion.

Mallya received a summons from the Special Court for Economic Offenses in Bengaluru on February 21, 2013, for neglecting to pay the tax that was withheld at the source. The problems only became worse when the CBI opened an inquiry into IDBI Bank’s ₹950 crore loan to Kingfisher in August 2014, raising concerns about why such a substantial sum was approved in the face of the airline’s worsening financial situation.

Kingfisher House in Mumbai was taken over by lenders in 2015, and Mallya was compelled to step down as chairman of United Spirits by Diageo due to allegations of money misappropriation. Banks took action to seize his passport by February 2016. In a matter of days, Mallya flew to London and discreetly left India.

In connection with the ₹9,000 crore bank loan fraud case, the Enforcement Directorate called on Interpol to issue a Red Corner Notice against him in June 2016.

By April 10, 2025, the Debt Recovery Tribunal reported that the entire amount owed, including interest and charges, had increased to ₹17,781 crore. Banks have collected ₹10,815 crore of this, with ₹6,997 crore remaining.

Mallya recently retaliated against public sector banks on X, writing, “The Indian Public Sector Banks who claim monies from me as a guarantor should be ashamed that they have not yet submitted an accurate statement of account of recoveries.”

What Forced The Tycoon To Flee?

Vijay Mallya departed India for the UK in March 2016, only one day before banks filed court motions to recoup unpaid debts, as the financial noose tightened. Mallya was officially charged with money laundering, criminal conspiracy, and fraud by investigative organizations such as the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED).

Luxurious homes, private aircraft, and other assets were seized and put up for auction by Indian authorities, who claim to have recovered more than ₹14,000 crore.

Under the new Fugitive Economic Offenders Act, Indian courts designated Vijay Mallya as the nation’s first “fugitive economic offender,” permitting the confiscation of his domestic assets prior to any conviction. Mallya, meantime, is still in the UK resisting extradition and denies any wrongdoing. He claims he is a victim of institutional and media vilification and attributes Kingfisher’s demise to business misfortune.

Is Mallya Really Unaffected By The Storm?

Despite the ongoing legal issues and financial scandals surrounding Kingfisher Airlines, Mallya maintains a pretty opulent lifestyle in the United Kingdom.

In order to avoid being arrested, he fled India in 2016. As of 2025, he is still in the UK on bail, while extradition and asylum-related hearings are ongoing. Mallya is active on social media, sharing posts about cricket, wishing people a happy holiday, and most recently being photographed at his son Siddharth’s wedding.

Even when Royal Challengers Bangalore (RCB), the IPL franchise he founded, won their first-ever IPL title in the 2025 season, ending an 18-year run without a championship, he tweeted.

In A Podcast With Raj Shamani

After nine years, Vijay Mallya has finally come out defending himself in a podcast with Raj Shamani. He expressed regret to former Kingfisher Airlines workers and insisted he didn’t flee, denying being a “chor.” Mallya attributed Kingfisher’s demise to drying funds, the 2008 global financial crisis, and the depreciation of the rupee.

He added that increased loans and debt resulted from the government’s discouragement of downsizing. Mallya also talked about being dubbed a fugitive, but he questioned why he was called a thief because banks had previously collected more money than was owed. He stated that if he was guaranteed a fair trial and respectable treatment, he would think about going back to India.

Conclusion

Kingfisher Airlines’ downfall remains a cautionary tale of how unchecked ambition, flawed strategy, and financial misjudgment can bring even the most glamorous brands to their knees. While Vijay Mallya continues to defend his actions, the airline’s collapse left behind unpaid employees, massive debts, and unanswered questions. More than a failed airline, Kingfisher stands as a reminder that style without sustainability can never keep a business airborne for long.

Follow Us: Facebook | Instagram | X |

Youtube | Pinterest | Google News |

Entertales is on YouTube; click here to subscribe for the latest videos and updates.